Business

MSFT Yahoo Finance: Unveiling Financial Insights

In the fast-paced realm of finance, knowledge is the key to informed decision-making, driving investors, professionals, and enthusiasts to seek reliable sources of information. As technology reshapes the accessibility of data, platforms like Yahoo Finance have emerged as indispensable tools for tracking market trends, monitoring stocks, and gaining valuable insights into companies. In this article, we delve into the significant role of Microsoft (MSFT) on Yahoo Finance, revealing how this partnership opens the doors to a wealth of financial knowledge at your fingertips.

Microsoft’s Global Tech Dominance:

It’s crucial to appreciate Microsoft’s position as a major player in the global tech industry before delving into the world of Yahoo Finance. The business, which Bill Gates and Paul Allen founded in 1975, has grown to become a major player in software, hardware, cloud services, and other industries. Microsoft has a vast portfolio that includes goods like Windows, Office, Azure, and Xbox, and its impact on the computer sector is genuinely enormous.

Yahoo Finance: The Nexus of Financial Insights:

Yahoo Finance, a subsidiary of Verizon Media, stands as a comprehensive online platform meticulously designed for tracking financial news, market data, and stock information. Offering real-time data, interactive charts, and tools for monitoring stock performance, researching companies, and making well-informed investment choices. Yahoo Finance boasts an intuitive interface that caters to both professionals and individuals seeking financial enlightenment.

The MSFT Encounter on Yahoo Finance:

When it comes to Microsoft’s stock (ticker symbol: MSFT), its presence on Yahoo Finance unveils a realm of invaluable insights. Here’s what awaits you when you navigate the MSFT experience on Yahoo Finance.

Real-Time Stock Data: Yahoo Finance provides you with up-to-the-minute details about MSFT’s stock price, trading volume, market capitalization, and other pivotal metrics. This data holds immense significance for investors keen on assessing the stock’s performance in the real world.

Interactive Charts: Visual representations of MSFT’s stock journey are at your disposal via interactive charts. You have the freedom to customize the time frame, compare MSFT’s performance against other stocks or indices, and meticulously scrutinize historical trends.

News and Analysis: Yahoo Finance meticulously curates news articles, press releases, and comprehensive analysis related to Microsoft. This all-encompassing coverage ensures that you remain well-informed about the latest developments that could potentially influence MSFT’s stock price.

Financial Statements: For those with a penchant for delving deeper, Yahoo Finance proudly offers MSFT’s financial statements, including income statements, balance sheets, and cash flow statements. This trove of financial data is essential for evaluating the company’s fiscal health.

Analyst Ratings: The platform conveniently assembles analyst ratings and recommendations for MSFT. These insights are of immense value for investors seeking expert viewpoints on the stock’s future prospects.

Community Engagement: Yahoo Finance actively fosters community interaction through its comment sections. Users can actively participate in discussions, share insights, and gain knowledge from the perspectives of fellow investors.

Empowering Informed Decision-Making

The synergy between Microsoft and Yahoo Finance symbolizes the powerful alliance between technology and finance. By providing an accessible gateway to comprehensive financial insights, Yahoo Finance equips you with the knowledge needed for well-informed investment decisions. Whether you’re a seasoned investor meticulously tracking stock performance or an inquisitive individual venturing into the world of finance. MSFT experience on Yahoo Finance serves as a portal to the intricate realm of stocks and markets. Yahoo Finance’s comprehensive coverage of Microsoft (MSFT) perfectly embodies its mission to offer users timely, precise, and holistic financial data. Through real-time stock updates, interactive charts, curated news, and expert analyses. Yahoo Finance empowers users with the essential tools to navigate the multifaceted landscape of finance. Microsoft’s influence continues to shape the technology sector. Yahoo Finance stands as a reliable ally for those striving to comprehend and participate in the world of finance.

Business

Unveiling the World of Amazon Reselling: Turning Products into Profits

In the dynamic landscape of e-commerce, entrepreneurs are constantly seeking innovative ways to capitalize on the vast potential of online marketplaces. One such avenue gaining significant traction is Amazon reselling. As a lucrative business model, Amazon reselling allows individuals to transform their entrepreneurial aspirations into reality by leveraging the global reach and customer base of the e-commerce giant. In this article, we delve into the world of Amazon reselling, exploring its key aspects and offering insights into how aspiring sellers can navigate this thriving marketplace.

Understanding Amazon Reselling

Amazon reselling, at its core, involves the practice of purchasing products from one source and then selling them on Amazon for a profit. The reseller acts as an intermediary, capitalizing on the vast online marketplace that Amazon provides. This business model offers several advantages, including low entry barriers, minimal upfront investment, and the potential for high returns. The reseller doesn’t need to create or manufacture products; instead, they focus on sourcing, marketing, and sales strategies to maximize profits.

Selecting Profitable Products

One of the critical aspects of Amazon reselling is the careful selection of products. Successful resellers invest time in market research to identify products with high demand and low competition. Tools like Amazon’s Best Sellers list and third-party analytics platforms can provide valuable insights into current market trends, allowing resellers to make informed decisions about which products to source.

Additionally, resellers must consider factors such as product size, weight, and Amazon’s storage fees to optimize their profit margins. Some experienced resellers specialize in niche markets, identifying unique products or catering to specific customer segments to establish a competitive edge.

Building a Reliable Supply Chain

Establishing a reliable supply chain is crucial for the success of an Amazon reselling business. Resellers can source products from a variety of channels, including wholesalers, manufacturers, liquidation auctions, and even retail stores. Building strong relationships with suppliers is essential to secure consistent inventory at competitive prices.

Furthermore, resellers should consider utilizing fulfillment services like Amazon FBA (Fulfillment by Amazon), which handles storage, packing, and shipping on behalf of the seller. This not only streamlines operations but also enhances the overall customer experience, as Amazon’s efficient logistics network ensures timely delivery.

Navigating Amazon’s Policies

To thrive in the world of Amazon reselling, it’s imperative to stay informed about Amazon’s policies and guidelines. Amazon has strict rules regarding product quality, authenticity, and customer service. Violating these policies can result in penalties, account suspension, or even expulsion from the platform. Resellers must stay abreast of changes in Amazon’s terms of service and compliance requirements to ensure a sustainable and long-term business.

Leveraging Marketing Strategies

In a crowded marketplace, effective marketing is key to standing out and driving sales. Amazon provides various tools and features to help resellers enhance their product listings, such as high-quality images, compelling product descriptions, and customer reviews. Additionally, resellers can leverage external marketing channels, including social media and email campaigns, to drive traffic to their Amazon listings.

Conclusion

Amazon reselling presents a compelling opportunity for aspiring entrepreneurs to enter the e-commerce arena without the complexities of product creation and manufacturing. With careful product selection, a reliable supply chain, adherence to Amazon’s policies, and strategic marketing, individuals can turn their passion for selling into a profitable venture. As the e-commerce landscape continues to evolve, Amazon reselling remains a dynamic and accessible avenue for those seeking financial independence and success in the digital marketplace.

Business

Bloomberg Finance: Navigating the World of Financial Insights

In the rapidly evolving world of finance, the value of being in the know cannot be understated. In order to make informed decisions when financial markets fluctuate and economic dynamics change, both professionals and laypeople search for reliable sources of information. Bloomberg Finance has emerged as a beacon of financial insight, offering a comprehensive platform that delivers real-time data, news, and analysis to empower individuals in their financial journeys.

The Influence of Current Data:

Bloomberg Finance’s dedication to real-time data is at the core of its attraction. Having access to accurate and recent information is essential in a world where split-second decisions can have significant effects. Users may precisely watch market movements with Bloomberg’s data feeds, which cover a wide range of assets from stocks and bonds to currencies and commodities.

A Wealth of Market Intelligence:

Bloomberg Finance is a source of thorough market insight rather than just a platform for data. Its extensive toolkit, charts, and analytics are relied upon by experts, traders, and investors to learn about market patterns, past performance, and connections between different assets. Whether it’s spotting emerging opportunities or mitigating risks, Bloomberg Finance provides the tools needed to make strategic decisions.

Breaking News and Analysis:

In the fast-paced world of banking, being current on breaking news and changes is essential. The dedicated team of journalists and analysts at Bloomberg Finance provides timely news updates, market analysis, and economic commentary. From corporate earnings reports to geopolitical shifts, users can access a wealth of information that helps them understand the factors driving financial markets.

Personalized Insights and Alerts

Recognizing that every individual’s financial journey is unique, Bloomberg Finance offers personalized features that allow users to set up alerts for specific assets, events, or market conditions. This customization ensures that users receive timely notifications relevant to their investment interests, enabling them to make swift decisions based on their chosen parameters.

A Global Community

Bloomberg Finance transcends borders, connecting individuals from different corners of the world who share a passion for finance. Its interactive platform facilitates discussions, debates, and knowledge sharing among users. The community aspect not only fosters collaboration but also provides an avenue for learning and staying updated on diverse perspectives within the financial realm.

Empowering Financial Literacy

One of the most commendable aspects of Bloomberg Finance is its role in empowering financial literacy. Through its extensive educational resources, webinars, and insights from industry experts, it seeks to bridge the knowledge gap and equip individuals with the tools needed to navigate the complex world of finance confidently. And Finally, Bloomberg Finance has redefined the way individuals engage with financial markets. From its real-time data feeds and comprehensive market intelligence to breaking news coverage and personalized insights, the platform serves as an indispensable companion for professionals and enthusiasts navigating the intricacies of the financial landscape. With its commitment to empowering financial literacy and fostering a global community, Bloomberg Finance continues to shape the future of informed decision-making in the world of finance.

Business

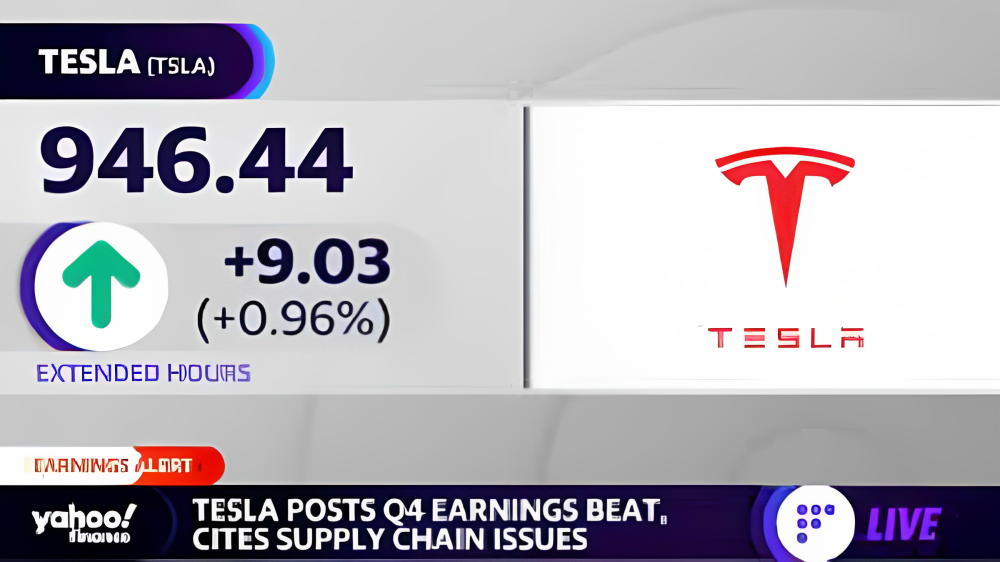

Tesla Yahoo Finance: A Comprehensive Analysis

Tesla has an indisputable impact on the automotive and IT industries in the fast-paced world of today, where innovation and technology go hand in hand. Understanding Tesla’s financial performance is essential if you’re an investor or fan. Using significant data from Yahoo Finance, this article delves deeply into Tesla’s financial situation in order to provide you a thorough insight.

Introduction Tesla Yahoo Finance

Investors and customers alike have been mesmerized by Tesla’s quick ascent from an ambitious startup to a world powerhouse in the automobile and renewable energy industries. This article seeks to offer a thorough examination of Tesla’s financial performance, using information from Yahoo Finance to identify the elements influencing its success and the difficulties it encounters.

Tesla: A Trailblazing Company

With its electric cars (EVs) and green energy solutions, Tesla, which was founded in 2003, upended the automotive sector. The corporation is at the forefront of technical progress because to Elon Musk’s innovative leadership and dedication to sustainability.

Exploring Tesla’s Stock Performance

Historical Stock Trends

Tesla’s stock price journey has been marked by extreme volatility and remarkable growth. From its initial public offering (IPO) at $17 per share in 2010 to reaching over $800 in recent years, the company’s stock has experienced wild fluctuations driven by various market forces.

Factors Influencing Stock Prices

Multiple factors impact Tesla’s stock prices, including:

1: Vehicle Deliveries: Quarterly vehicle delivery numbers often correlate with stock movement.

2: Technological Breakthroughs: Announcements about battery technology and self-driving capabilities.

3: Market Sentiment: Public perception of the company, which can be influenced by media coverage and social media.

Tesla’s Financial Health

Revenue Growth and Sources

Tesla’s revenue growth has been remarkable, fueled primarily by vehicle sales. The company’s expansion into energy solutions like solar panels and energy storage has also contributed to its revenue streams.

Profitability and Margins

While Tesla’s revenue has surged, achieving consistent profitability has been a journey. The company’s ability to control manufacturing costs and improve margins has a direct impact on its bottom line.

Debt and Liabilities

Tesla’s ambitious projects require substantial investments, which have led to increased debt. Balancing growth with managing debt remains a challenge for the company.

Market Capitalization and Competition

Tesla, one of the most valued companies in the world, is extremely valuable on the market. The company’s financial performance as well as the idea that it can reshape various industries have both had an impact on its price.

Elon Musk’s Impact on Tesla’s Finances

Musk’s Compensation

Elon Musk’s unconventional compensation packages, tied to Tesla’s market value and performance, have been a subject of both admiration and criticism.

Leadership’s Role in Financial Strategy

Musk’s leadership plays a significant role in shaping Tesla’s financial strategy. His ambitious goals often influence the company’s investments and priorities.

Global Expansion and Its Financial Implications

Tesla’s global expansion has been a crucial growth driver. However, factors like regulatory challenges and market dynamics in different regions introduce financial complexities.

Electric Vehicle Industry Trends

As the EV industry evolves, Tesla faces competition from established automakers and emerging startups. Staying ahead in this competitive landscape requires ongoing innovation.

Innovation and Research Spending

Tesla’s commitment to technological innovation is evident in its significant research and development expenditures. These investments are essential for maintaining a competitive edge.

Sustainability Initiatives and Costs

Tesla’s mission to accelerate the world’s transition to sustainable energy comes with its own set of costs. Balancing environmental responsibility with financial viability is an ongoing challenge.

Future Projections and Analyst Insights

Expert Opinions on Growth

Financial experts project a bright future for Tesla, citing its innovation, expanding market share, and potential in renewable energy.

Anticipated Challenges and Opportunities

Challenges such as supply chain disruptions and regulatory hurdles could impact Tesla’s growth trajectory. However, these challenges also present opportunities for the company to adapt and excel.

Risks and Risk Management

Regulatory Challenges

Regulatory changes in the automotive and energy sectors can significantly influence Tesla’s operations and financial performance.

Supply Chain Dependencies

Tesla’s complex supply chain is vulnerable to disruptions, which can have cascading effects on production and financials.

Tesla’s Investor Relations

Communication Strategies

Tesla’s communication with investors, characterized by Musk’s Twitter presence, unconventional earnings calls, and public statements, adds a unique dimension to its investor relations.

Shareholder Engagement

Tesla’s passionate and engaged shareholder base influences discussions about the company’s financial decisions and strategic direction.

Conclusion

Finally, Tesla’s financial history is evidence of its tenacity, creativity, and Elon Musk’s inspirational leadership. Tesla is navigating the difficulties of the quickly changing automotive and energy sectors while enthralling the globe with its cutting-edge innovations and dedication to sustainability.

FAQs

- Is Tesla profitable?

- Yes, Tesla has shown periods of profitability, driven by vehicle sales and cost-saving initiatives.

- What drives Tesla’s stock price changes?

- Tesla’s stock price is influenced by factors like delivery numbers, technological advancements, and market sentiment.

- How does Elon Musk affect Tesla’s finances?

- Elon Musk’s leadership shapes Tesla’s financial strategy, and his compensation is tied to the company’s performance.

- What risks does Tesla face?

- Tesla faces risks from regulatory changes, supply chain disruptions, and intense competition in the EV industry.

- Why is Tesla’s market capitalization so high?

- Tesla’s high market capitalization reflects investors’ confidence in its potential to revolutionize transportation and energy.

-

Health And Fitness11 months ago

Health And Fitness11 months agoHow Tall Is Kai Greene, the Phenomenal Bodybuilder?

-

News11 months ago

News11 months agoDiscordant former prime minister Thaksin Shinawatra has returned to Thailand after 15 years.

-

Health And Fitness11 months ago

Health And Fitness11 months agoPartners in Health: Fostering Wellbeing and Collaboration

-

News11 months ago

News11 months agoAudeze, audio technology company will be acquired by Sony

-

News11 months ago

News11 months agoThere may be concerning delays for the iPhone 15 Pro Max-and the cameras are to blame

-

Tech11 months ago

Tech11 months agoXCV Panel: Streamlining Your Workflow Like Never Before

-

Business11 months ago

Business11 months agoTesla Yahoo Finance: A Comprehensive Analysis

-

Gaming11 months ago

Gaming11 months agoExploring the NYT Connections Game: A Fascinating Dive into Word Associations